Free North Carolina Durable Power of Attorney Forms

A durable power of attorney (POA) is a legal document that allows a person to make decisions on behalf of another even after legal incompetence. The document involves two people: the principal, who entrusts authority, and the agent, who makes the legal decisions.

North Carolina Durable Power of Attorney Laws

The North Carolina General Statutes Chapter 32C, also known as the North Carolina Uniform Power of Attorney Act, sets the rules for the creation of durable POAs in North Carolina. The poignant provisions of the law include the following:

- Definition of Agent - An agent is described as “a person granted authority to act for a principal under a power of attorney, whether denominated an agent, attorney-in-fact or otherwise. The term includes an original agent, coagent, successor agent, and a person to which an agent's authority is delegated (North Carolina General Statutes § 32C-1-102).”

- Definition of Durable - It is considered a durable POA because when the principal becomes incapacitated, the document is not affected or terminated. Incapacity is defined as the inability of an individual to manage property or business affairs because the individual has an impairment or is missing, detained, or outside the United States and unable to return (North Carolina General Statutes § 32C-1-102).”

- Execution of Power of Attorney - The document must be signed by the principal and acknowledged by a notary public in North Carolina (North Carolina General Statutes § 32C-1-105).

Signing Requirements in North Carolina

The principal must sign the North Carolina POA. If they are unable to sign, the law states that it has to be signed “in the principal’s conscious presence by another individual directed by the principal to sign the principal’s name on the power of attorney and acknowledged (North Carolina General Statutes § 32C-1-105).”

Thus, a North Carolina notary public must acknowledge the POA.

How To Write a Durable POA in North Carolina

A North Carolina durable POA is a type of POA that remains in effect even when the principal becomes incompetent. It gives the agent permission to make decisions on the principal’s behalf. The decisions may include financial management, healthcare administration, and other legal affairs.

Here are the steps in creating a durable POA.

1. Choose Someone You Trust To Be Your Agent

Being an agent in a durable POA is a crucial responsibility. You need someone you trust with your money and life. In most cases, a principal chooses a family member to become an agent who then acts and makes decisions on behalf of the principal on many matters.

When it comes to financial aspects, an agent may make deposits or withdrawals from your bank account. They can sign documents or purchase real estate.

The agent will also take care of your medical needs. They can decide on medical treatments and surgeries. They may also have the difficult task of making end-of-life decisions for you. So, select your agent carefully.

2. Discuss Your Agent’s Powers

Once you’ve chosen your agent, discuss their responsibilities. It is up to you whether you want to give them blanket responsibilities or specific responsibilities. But it is an advantage for both parties if you specify them.

Another important point to mention is compensation since the agent is usually compensated for their duties even if they are family.

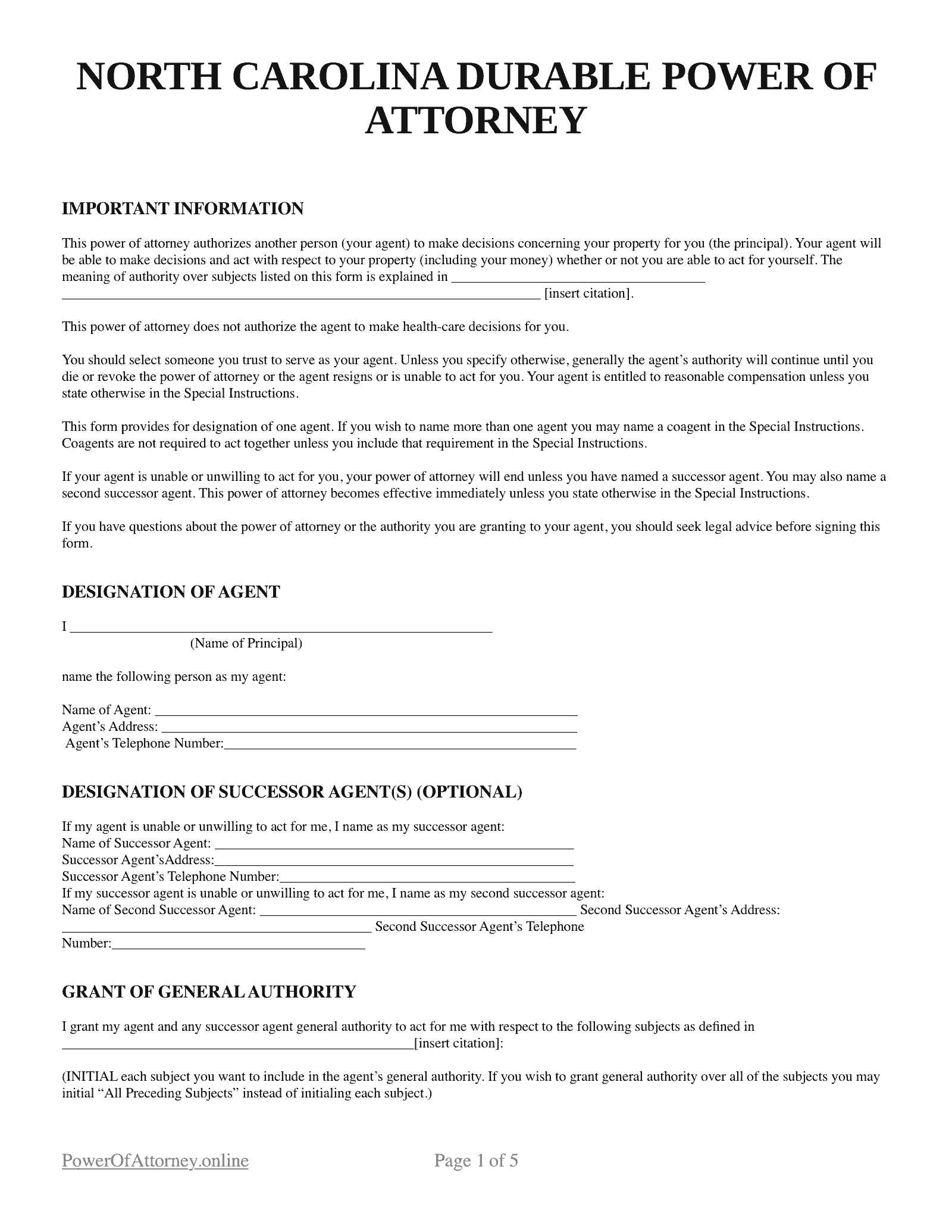

3. Complete Your North Carolina Durable POA

Download a printable North Carolina durable POA template. Make sure it’s in the acceptable format and content for the state of North Carolina. Different states have different acceptable forms.

Read through the content and add your specific requirements, and then sign the form. According to the North Carolina Statutes, a notary public must acknowledge the signed form so it can be legal and executory.

If you are unable to sign the form for whatever reason, you have to give your express consent to another who can sign on your behalf.

4. Start Using Your Durable POA

Give one copy to your agent of your document and keep another copy for yourself. More often, the agent has to show the POA to various entities when they exercise their responsibilities on behalf of the principal.