Free Kentucky Durable Power of Attorney Forms

A Durable Power of Attorney (DPOA) is a legal instrument where an individual, termed the "principal," grants permission to another, referred to as the "agent" or "attorney-in-fact," to decide for them.

Contrary to a healthcare power of attorney, the determinations made by an agent on a DPOA predominantly concern financial or individual affairs. Different from a standard power of attorney, a DPOA retains its validity even when the principal is incapacitated.

Kentucky Durable Power of Attorney Laws

Several laws in the state of Kentucky outline the nature of a Durable Power of Attorney and detail its legal creation and usage.

- Durable Power of Attorney definition: A Durable Power of Attorney refers to a power of attorney that is not terminated by the principal's incapacity. It ensures continuous representation even if the principal is unable to make decisions (§457-020).

Signing Requirements in Kentucky

To activate a Durable Power of Attorney in Kentucky, adherence to the state's signing criteria is essential.

Meeting these stipulations ensures your DPOA gains legal acknowledgment.

- Signing requirement: The principal should sign the document in front of a notary public “or other individual authorized by law to take acknowledgments” (§457-050).

How To Write a Durable POA in Kentucky

Establishing a legally recognized Durable Power of Attorney in Kentucky is crucial for empowering a trusted person to decide for you.

Refer to the guide below to craft a document that encompasses your wishes and safeguards your rights.

1. Choose an agent

Select an agent you profoundly trust, be it a close relative, a dear friend, or a reliable advisor.

The individual in consideration should exhibit sound financial acumen.

If your primary selection is hesitant or can't represent you when required, consider appointing a secondary agent.

2. Explain the powers with your agent

Before documenting, engage in a conversation with your prospective agent.

Explore the extent and boundaries of the authorities you intend to delegate.

This might span from overseeing financial activities to pivotal banking choices. They should grasp your inclinations and their constraints to act on your behalf.

Ensure they're ready to shoulder the responsibility.

3. Address compensation

Serving as an agent can demand considerable dedication. Determine if you'll offer remuneration for their efforts. This could be a fixed fee, a per-hour charge, or a reimbursement model for potential costs.

Clear communication upfront can avert future disagreements or confusion.

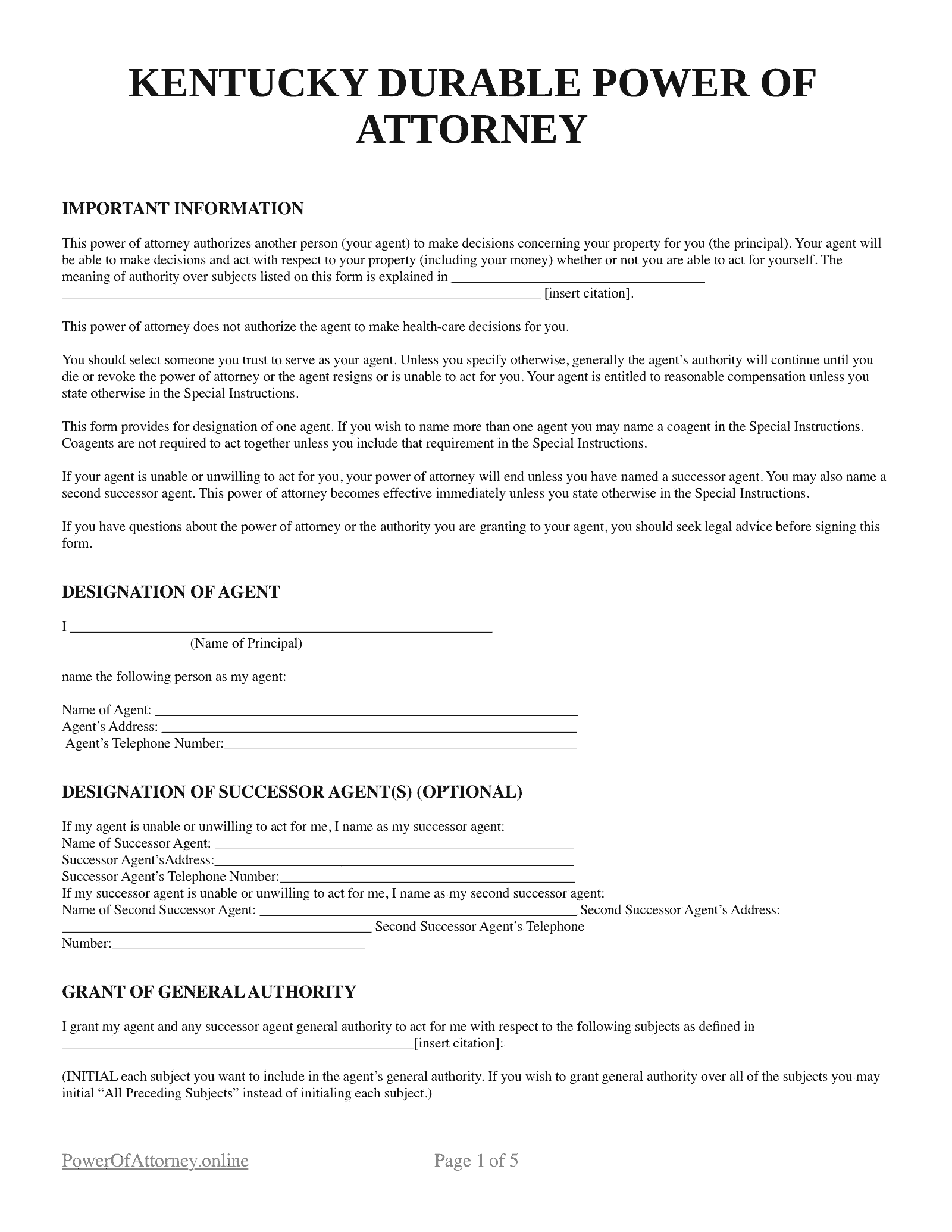

4. Download a Kentucky Durable POA Form

Leveraging a printable DPOA form minimizes mistakes and guarantees legal thoroughness.

With our template, tailor your document to reflect your financial wishes while adhering to state regulations.

5. Complete the form

With your form at hand, add all vital powers your agent should recognize, such as:

- The DPOA's start date

- Their fiscal duties

- Their compensation structure and responsibilities

- The DPOA's continuity, even if you become incompetent

You may also add any instructions you consider necessary.

6. Sign

Now, it’s time to endorse the document before the mandatory witnesses.

A Kentucky Durable Power of Attorney should be signed with a notary public witnessing to be legally binding. If you're physically incapacitated to sign, an adult can be authorized on your behalf.

This confirms your deliberate and willing choice to bestow the delineated powers in the document.