Free New Hampshire Durable Power of Attorney Forms

A power of attorney (POA) is a legal document that allows a principal to appoint an individual, referred to as an agent or attorney-in-fact, to make decisions on their behalf. Generally, POAs lose their power when the principal becomes incapacitated. The situation may affect some business programs, financial matters, and other legal affairs.

To prevent stalling the business or delaying urgent matters, sign a durable POA. It is a legal document wherein the authority continues despite the principal’s incapacity.

New Hampshire Durable POA Laws

- 2022 New Revised Statutes: Title 564-E - Uniform Power of Attorney Act - the main law that sets the guidelines for how POAs are implemented in New Hampshire. It states: “A power of attorney created under this chapter is durable unless it expressly provides that it is terminated by the incapacity of the principal” (NH Rev Stat § 564-E:104).

Signing Requirements in New Hampshire

An agent acts on behalf of the principal when armed with a New Hampshire POA. Typically, the principal must sign it. But, if, for any reason, the principal cannot physically sign it, they can ask somebody else to sign it on their behalf.

The principal needs to express their consent to the signature. It becomes legal in the state when it is acknowledged by a notary public (NH Rev Stat § 564-E:105).

How to Write a Durable POA in New Hampshire

The agent uses the POA as permission to make decisions on behalf of the principal. Here are the steps to follow when creating a durable POA in New Hampshire:

1. Select a person you can trust to appoint as an agent

The agent’s responsibilities are crucial. When it comes to a durable POA, you are basically giving the agent the power to be you, especially at a time when you may become incapacitated.

The obvious choice is to choose a family member. It could be a spouse, sibling, child, or parent. It could also be a relative, business partner, or lawyer. The durable POA is applicable for either general, limited or healthcare POA. Sometimes, the type of POA matters when choosing an agent. For example, a family member may be better off deciding your medical and healthcare plans, while a business partner or lawyer is better for business, legal, and financial matters.

2. Discuss your wishes with your agent

Just because the agent will decide for you doesn’t mean you don’t get your way. It is important that you talk to the agent so they will understand what you need from them.

The Healthcare POA is almost always durable. It is essential that you impart your end-of-care wishes to your agent since this may be sensitive, especially with a family member as an agent.

Another important topic to discuss is compensation. Agents have the right to receive compensation for the performance of their duty. Many don’t wish to, particularly if they are family members.

Agents may also receive refunds for transportation and other expenses while carrying out their responsibilities.

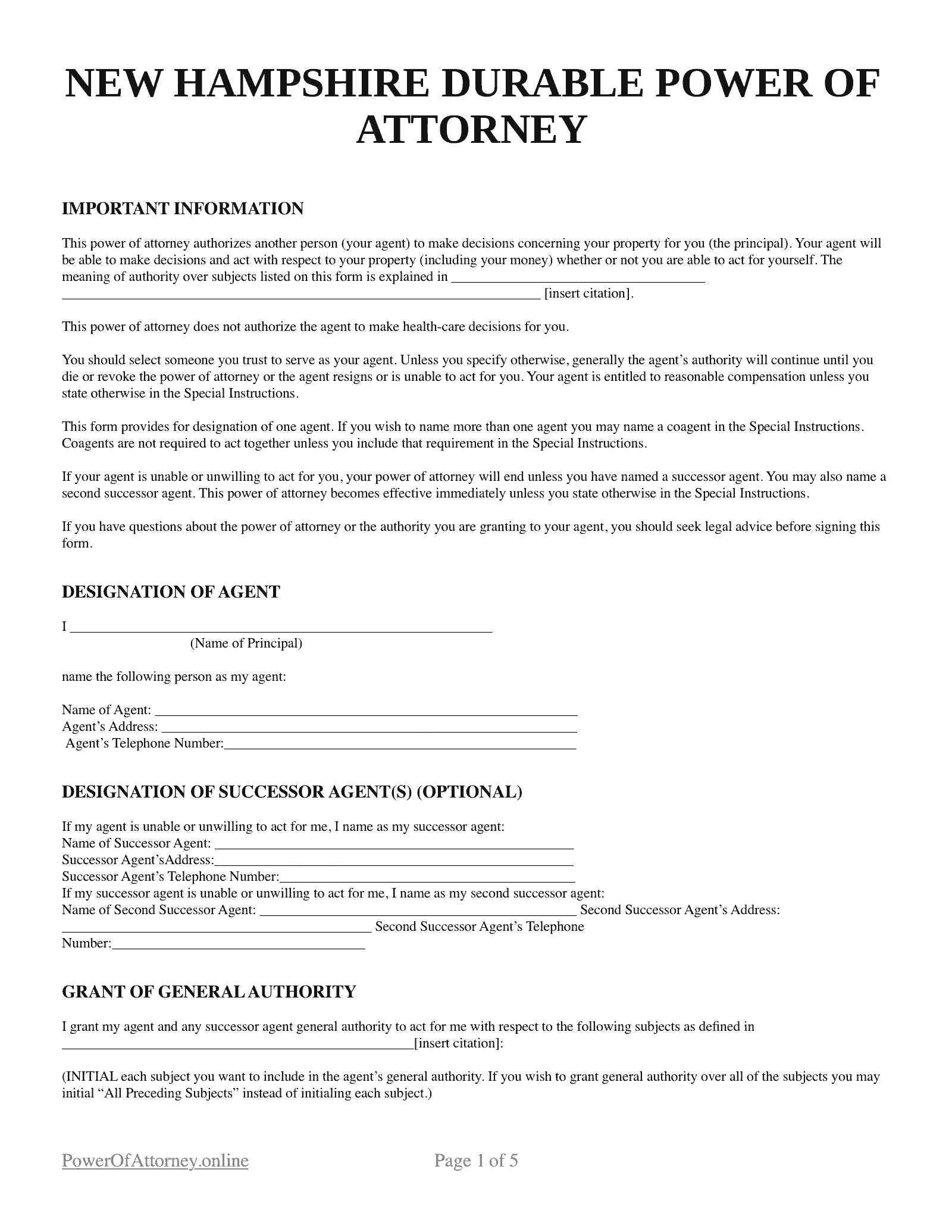

3. Download and fill out printable New Hampshire Durable POA

For your convenience, find a POA template online. Make sure it is applicable in New Hampshire, as rules differ in each state. Fill out the blank parts and ensure you include all your wishes in case of incapacity. Be as specific as you can to prevent any confusion on the agent's part.

4. Sign the POA Form

Sign and date the POA form. If, in any case, you are unable to sign it physically, you can ask somebody else to sign on your behalf. It becomes official when duly acknowledged by a notary public.

5. Give relevant people a copy of the POA

You must have a copy of the POA, as should the agent. The agent must bring the document with them every time they make decisions on your behalf. It is also prudent to provide important people in your personal and professional life copies of the documents for easy transition.

You can now use the durable POA in New Hampshire, and the agent can start deciding for you on various matters.