Free Minnesota Durable Power of Attorney Forms

A durable power of attorney (POA) enables a person, referred to as the principal, to appoint another to make business and legal transactions on their behalf. However, while most POAs expire when the principal is incapacitated, the authority of a durable POA remains valid after incapacitation.

The purpose of the durable POA is to allow businesses to keep operating in the event that the principal suffers incapacity. Without a durable POA, the affairs of an individual may suffer from various financial, legal, and business consequences if they were to suddenly stop attending to them.

A durable POA can be extremely useful since it allows a trusted representative to step in and make decisions for the principal once the principal has been legally declared incompetent.

Minnesota Durable Power of Attorney Laws

- Minnesota Statutes Section 523.07 - This is the main law that covers Minnesota's durable powers of attorney. A form is considered durable as long as it contains the following statement: “This power of attorney shall not be affected by incapacity or incompetence of the principal” (MN Stat §523.07).

- Record keeping - The agent must keep all transaction records made on behalf of the principal. The principal can also ask for these records periodically. In addition, the agent must maintain a list of expenditures and reimbursements.

Signing Requirements in Minnesota

The Minnesota POA must be written. It becomes valid once signed by the principal and acknowledged by a notary public. If the principal, for any reason, cannot sign the document, they can designate another person to sign on their behalf. Again, the notary public must acknowledge it.

How To Write a Durable POA in Minnesota

A durable POA acts as written permission for the agent to handle the affairs of the principal. Its authority will continue to be honored even after the principal’s incapacity. You can get a durable POA in Minnesota with the following steps:

1. Choose the Agent

Selecting an agent you trust is crucial because a POA essentially allows them to handle your affairs as if they were you. These may be financial, legal, business, or personal in nature.

Most people prefer to assign a family member as their agent, while some prefer a lawyer or business partner. When selecting an agent, the principal must consider if the agent has their best interest at heart. So, if the time comes that the principal is declared legally incompetent, they will carry out the wishes of the principal.

2. Discuss the Responsibilities With the Agent

The agent becomes the decision-maker when a durable POA is signed. The principal should properly explain their motivation for sharing the burden of their responsibilities. Moreover, the principal must explain which acts or transactions they want the agent to take care of in case they become incapacitated.

In the case of healthcare POAs, which are usually durable in nature, the agent will be responsible for deciding the principal’s medications, treatments, procedures, and end-of-life care. The principal must communicate their healthcare preferences so that the agent can faithfully carry them out.

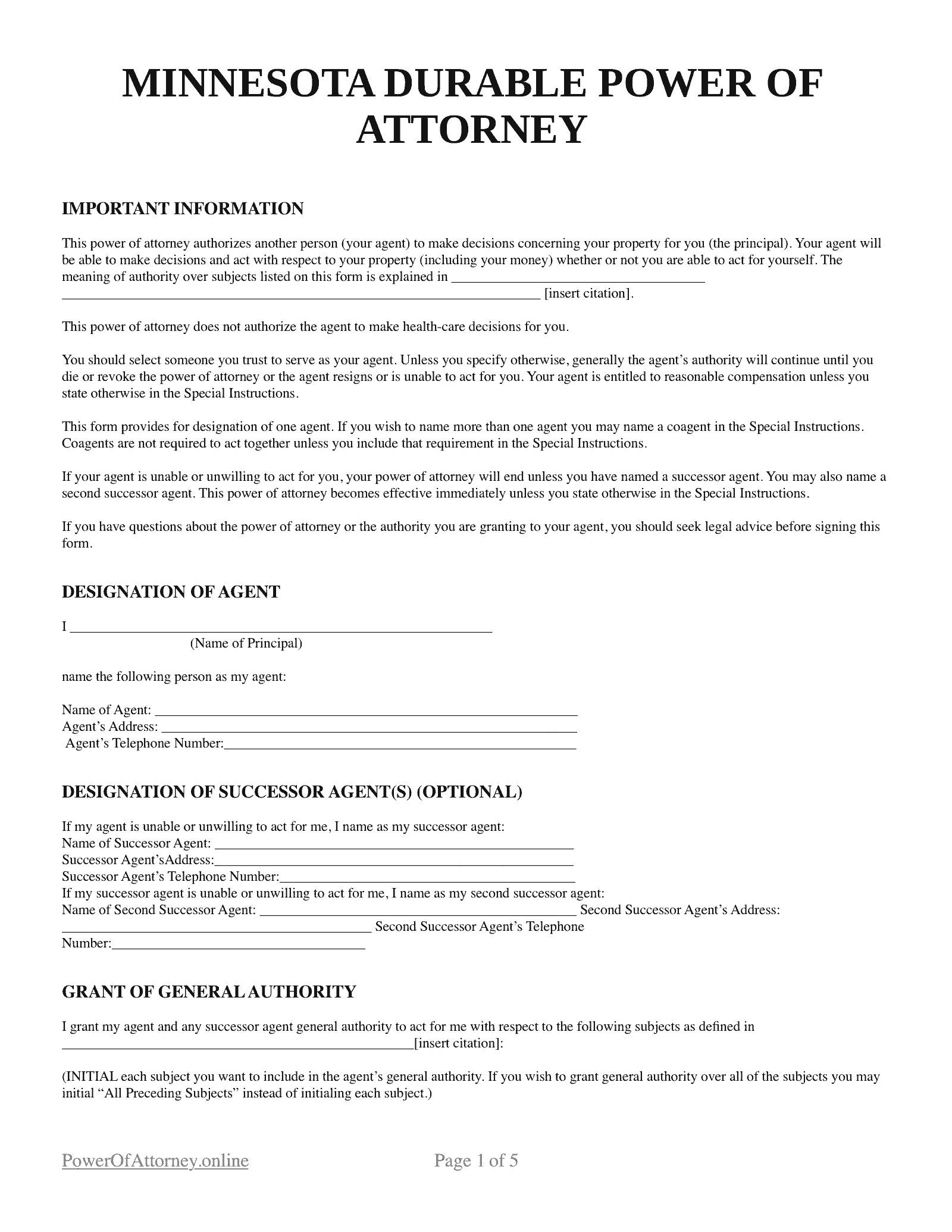

3. Download a Printable Power of Attorney Form

For convenience, download a Minnesota POA template online. This is easier for the principal because all they have to do is fill out the form based on their needs. Make sure to use the format that is acceptable in Minnesota.

The principal must double-check the form to ensure everything they need and want from an agent has been laid out. To prevent confusion, the more specific the document, the better.

4. Sign the Minnesota POA

Every state has different requirements. In Minnesota, the principal must sign the POA and have a notary public acknowledge it to be valid.

5. Use the Minnessota POA Form

Once signed, the agent can start using the POA to make transactions on behalf of the principal. The agent can use the POA for a variety of activities. For example, the agent can make real estate transactions on behalf of the principal. The form must be presented during such transactions.

Other activities agents can take care of include:

- Bank deposits and withdrawals

- Handling of retirement accounts

- Picking up mail from P.O. boxes

- Buying and selling properties, such as automobiles or jewelry

- Paying taxes

- Other legal transactions

As you can see, these activities are major, highly sensitive, and personal, so agents must be carefully selected.