Free Kansas Durable Power of Attorney Forms

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the “principal,” to grant permission to another person, called the “agent” or “attorney-in-fact,” to make choices on their behalf.

Unlike a healthcare power of attorney, the decisions an agent listed on a DPOA are related more to financial or personal matters.

Unlike a regular power of attorney, a DPOA remains effective even if the principal becomes incapacitated.

Kansas Durable Power of Attorney Laws

Various statutes define what a Durable Power of Attorney is in the state of Kansas and mention how it can be created and used legally.

- Durable Power of Attorney definition: Kansas law defines a DPOA as “a written power of attorney in which the authority of the attorney in fact does not terminate in the event the principal becomes disabled” (§58-651).

Signing Requirements in Kansas

To put a Durable Power of Attorney into effect in Kansas, you will need to meet the state’s signing requirements.

Complying with these requirements is necessary for your DPOA to be legally recognized.

- Signing requirements: The document must be signed by the principal in the presence of a notary public.

If you, as the principal, are unable to sign the document, it may be done by an adult in your place (§58-652).

How to Write a Durable POA in Kansas

Creating a legally valid Durable Power of Attorney in Kansas is essential if you want to ensure that a trusted individual can make choices on your behalf.

Use the following detailed guide to help you draft a document that covers all of your preferences and protects your interests.

1. Decide on an agent

When deciding on your agent, select someone you deeply trust, whether it's a close family member, a lifelong friend, or a trusted advisor.

Whoever you consider should have good financial judgment.

You can also select a backup agent if your primary choice is unwilling or unavailable to act on your behalf when needed.

2. Discuss the powers with your agent

Before putting anything in writing, sit down with your potential agent. Discuss the range and limits of the powers you're considering granting.

This could range from managing financial transactions to making important banking decisions. They must understand what your preferences are and their limitations. You can also make certain they are willing to take on the responsibility.

3. Mention any compensation

Acting as an agent can sometimes involve significant time and effort. Decide if you'll compensate them for their services. This could be a structured fee, an hourly rate, or a reimbursement system for expenses they might incur.

Being transparent about this from the outset can prevent potential disputes or misunderstandings in the future.

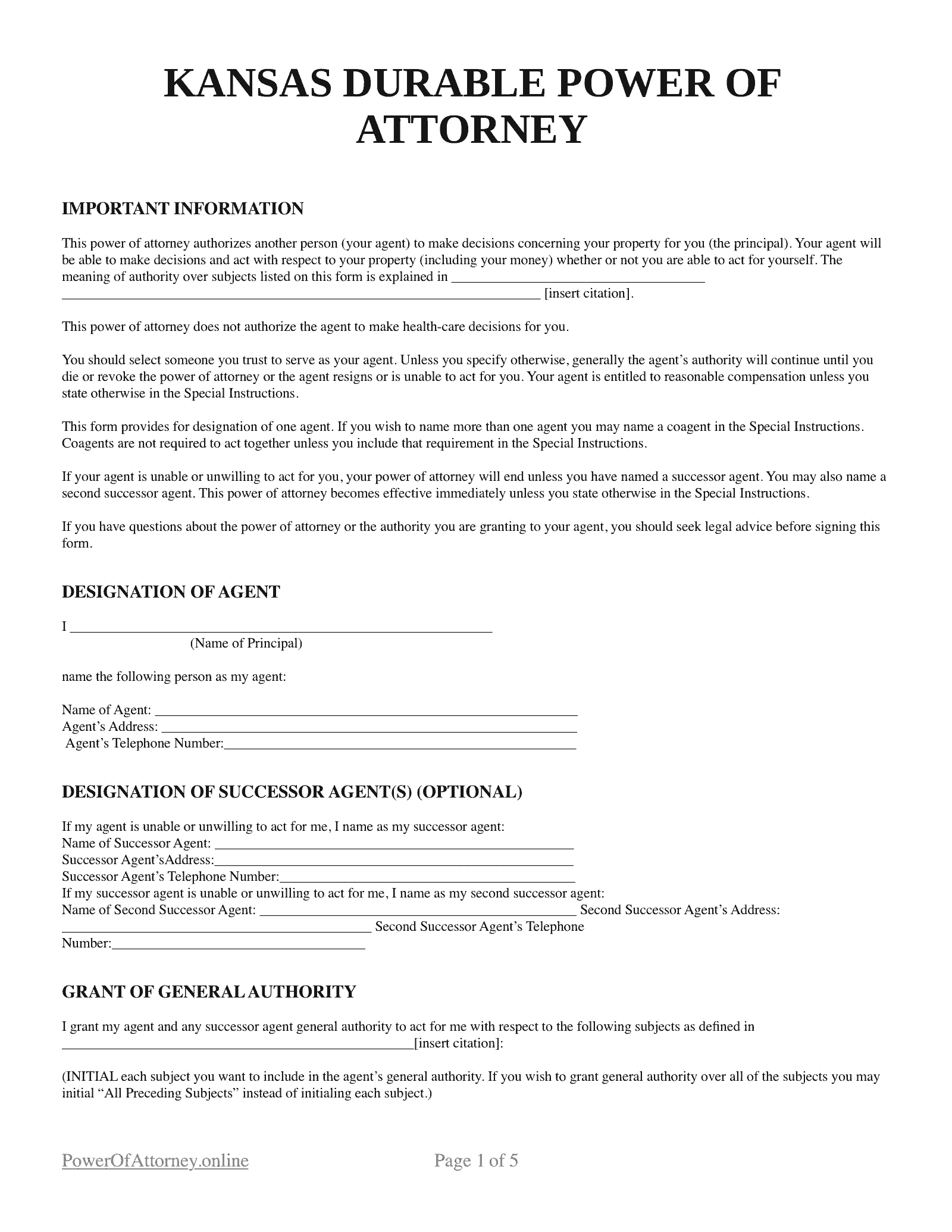

4. Download the Kansas Durable POA Template

Using a printable DPOA template helps you avoid errors and can ensure that you're covering all legal bases.

By using our template, you can customize your document to mention your financial preferences while complying with state laws.

5. Fill in the document

After you have your template, fill in all the necessary powers and sections that your agent should be aware of, such as:

- The start date of the DPOA

- Their financial responsibilities

- What they will be paid, and for which duties

- If the DPOA remains in effect even if you are incompetent

After ensuring these are all included in your form, you can add any extra instructions.

6. Sign the Durable Power of Attorney

Once you have included all the necessary information, you must sign the document in front of the required witnesses.

As previously mentioned, in Kansas, you must sign a Durable Power of Attorney in the presence of a notary public for it to be considered legally valid. If you are physically unable to sign the form, you can designate someone of legal age to do it for you.

This will confirm your conscious and voluntary decision to grant the powers outlined in the document.