Free Indiana Durable Power of Attorney Forms

An Indiana durable power of attorney (POA) is a legally binding document that allows someone (referred to as the principal) to appoint another (otherwise known as the agent) to make important decisions on the principal’s behalf. Unlike other types of POAs, a durable POA remains in effect even after the principal becomes incapacitated.

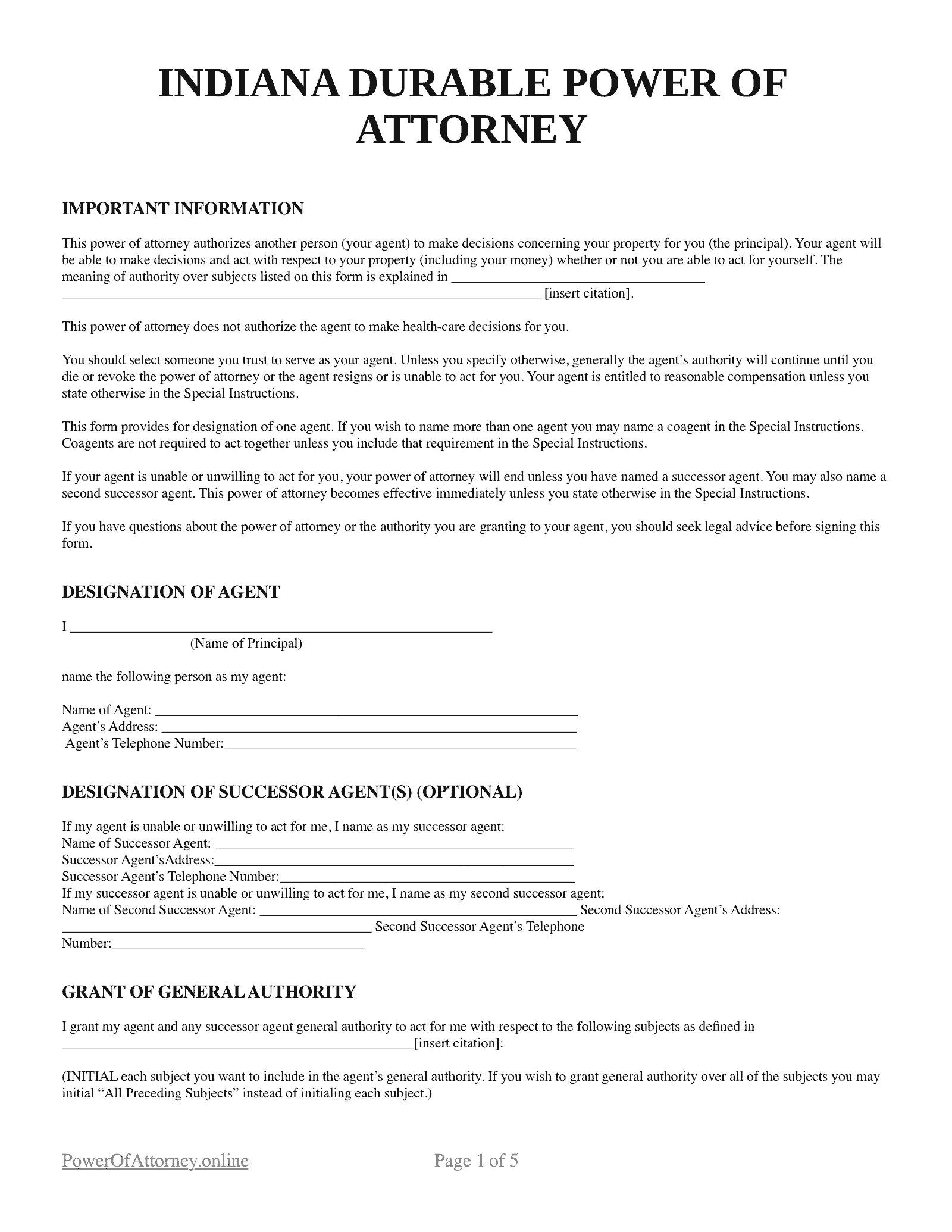

Indiana Durable Power of Attorney Laws

- Creation of the Power of Attorney - The POA must be in written form to be valid and have the name of the attorney-in-fact or the agent. Furthermore, the principal must sign the document in the presence of a notary public. “In the case of a POA signed at the direction of the principal, the notary must state that the individual who signed the POA on behalf of the principal did so at the principal’s direction” (IC § 30-5-4).

- Duties of the Attorney-in-fact - The agent must exercise authority in a fiduciary capacity and keep a complete record of all the transactions they have done on behalf of the principal. Records must be kept for at least six years or until the records are given to the successor agent (IC § 30-5-6-4).

Signing Requirements in Indiana

The principal must sign the Indiana durable POA in the presence of a notary public. According to Indiana statutes, there is no need for an additional witness (IC § 30-5-4-1).

How To Write a Durable Poa in Indiana

An Indiana durable power of attorney is written permission for an agent to represent the principal in the management of various legal affairs involving assets, properties, finances, minor children, and healthcare, among others. The validity of the document continues even when the principal becomes incompetent due to health and various reasons.

Follow these steps to write a durable POA:

1. Appoint an agent

An agent has the very important responsibility of acting on behalf of the principal. It’s essential that the principal only appoints someone they can trust, especially since the durable POA remains in effect until the principal dies.

The range of responsibilities is also wide, including finances, which are often a cause of disputes in the family. A durable POA can also cover healthcare, which may entail life-and-death matters. Because of the gravity of the agent’s responsibilities, the principal must select someone who understands the implications of the POA and the obligations that come with it.

When you’ve decided on an agent, discuss the responsibilities and your special instructions, and make sure that they can handle them. While everything may be written in the POA, it’s still better to have verbal communication with your agent so that you can communicate better.

2. Create the Indiana durable POA

There are a few ways to create an Indiana durable POA. You can have a law firm create it for you. However, you can also download a printable template online for free. Make sure you print a copy based on Indiana statutes so it has all the necessary elements of a valid Indiana POA.

As soon as you have the form, review the content and customize it according to the powers you want to bestow on your agent. Among the most common are banking transactions, real estate transactions, retirement plans, business operations, bond and security transactions, and healthcare management.

3. Sign the Indiana durable POA

The POA acts as authority for the agent to handle various matters on behalf of the principal. However, it only becomes effective when it is signed. In Indiana, the main requirement is you sign it in the presence of a notary public.

4. Distribute copies of the POA

Make sure you have multiple copies of the POA. Keep your copy in a safe place and inform your immediate family where it is so they can access it in case you have become incapacitated. Give your agent a copy of the POA too. Also, provide all the significant parties with a copy of the durable POA.