Free Power of Attorney Forms

A Power of Attorney (POA) is a legal document that allows an individual, also known as the 'principal', to grant another individual the power to act on the principal’s behalf in areas related to finance, real estate, healthcare, taxes, guardianship, and more. The individual who receives the power to act on the principal’s behalf is called the 'agent'.

Power of Attorney differs from state to state, depending on different state laws and guidelines. The extent of the power granted to the agent depends solely on the principal who has created the document.

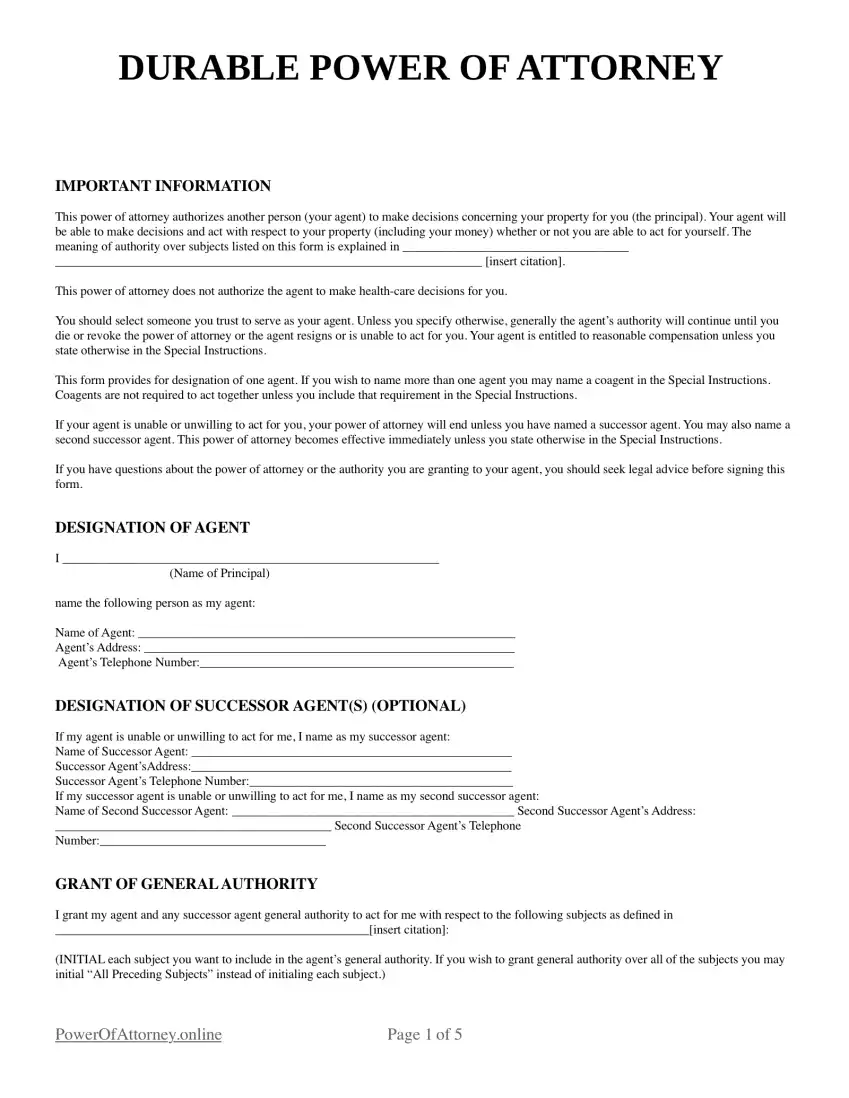

![Imagen Durable Power of Attorney]() Durable Power of Attorney Forms

Durable Power of Attorney FormsA durable Power of Attorney form (DPOA) is a legal document that an individual can fill out to give control of their assets or responsibilities to another individual. The person who creates the form and wishes to transfer authority is called the ‘principal.’ The person who receives the authority is called the ‘agent’ or the ‘attorney-in-fact.’

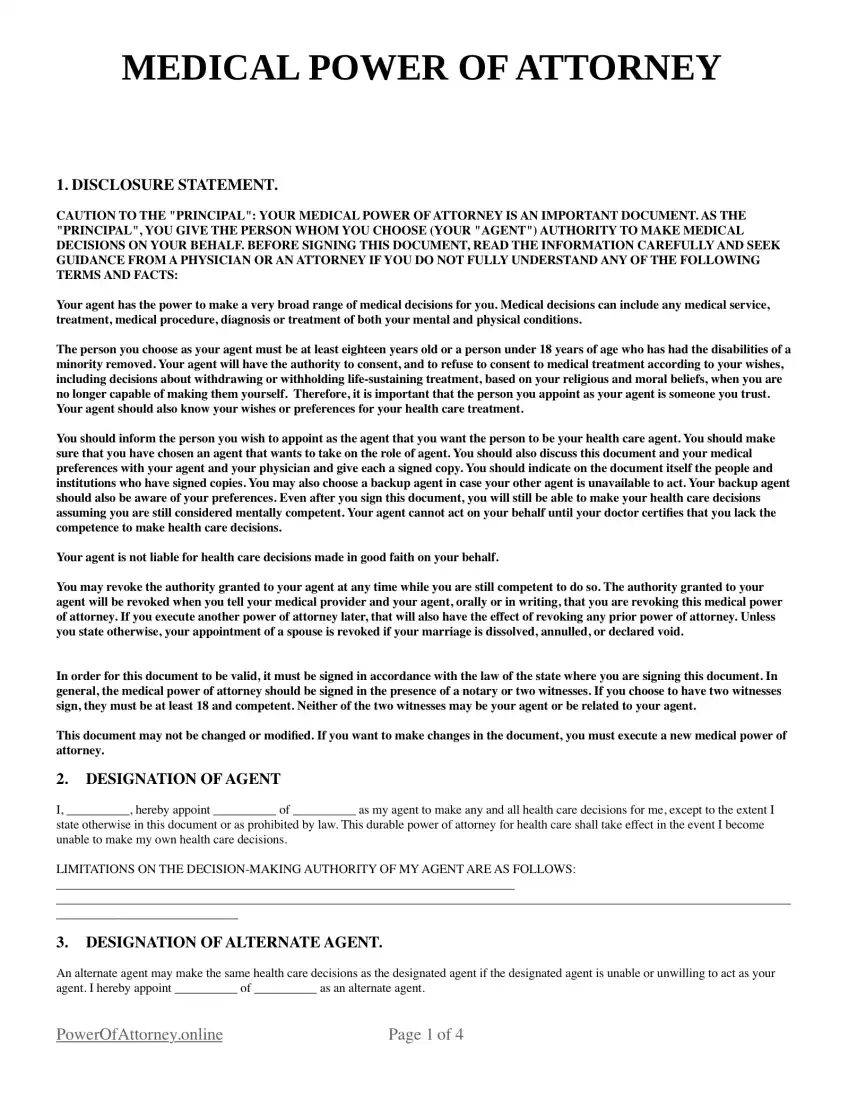

![Medical Power of Attorney Forms Image]() Medical Power of Attorney Forms

Medical Power of Attorney FormsA Medical Power of Attorney form, a specific type of advance directive, is a binding legal document that allows a person to transfer authority over their healthcare matters to another person.

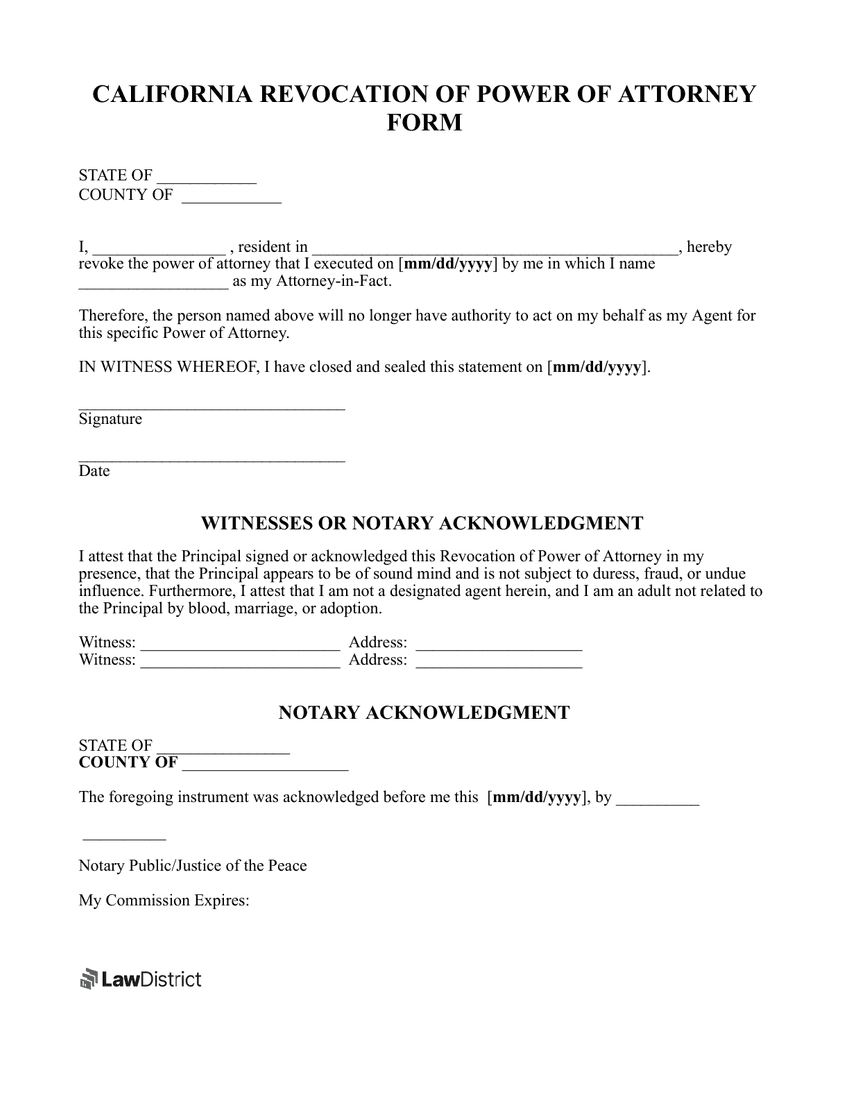

![poa-california-revocation-of-power-of-attorney-sample]() Revocation Power Of Attorney

Revocation Power Of AttorneyA Power of Attorney Revocation Form is a legal document that allows someone (known as the principal) to officially cancel a previously granted power of attorney. A POA revocation form takes away the assigned agent’s legal permission to act on behalf of the principal. These forms can be used to make null and void all types of Power of Attorney, be it financial, medical, or general.

The legal requirements when filling out a Power of Attorney Revocation vary from state to state. The agent and any other parties involved in the POA must be properly notified for the revocation to be effective.

Power of Attorney Forms by Type

POA forms are utilized when the principal no longer wishes to manage their affairs and responsibilities. This could be due to old age, an ailment or disability, frequent travels outside of the country, or if one wants to relinquish control to a specific person. Let’s look at different types of POA forms the principal can fill out to grant specific areas of control:

Durable (Financial) Power of Attorney

A durable or financial Power of Attorney is a document that allows the principal to assign control in matters of their finances to another person (‘agent’) they trust. This generally happens when the principal becomes incapacitated or incompetent and cannot manage their financial responsibilities (like investments or assets) by themselves.

General Power of Attorney

A General Power of Attorney allows the principal to assign general or specific powers to the agent in terms of controlling their financial matters. The difference between a general and durable POA is that a general POA can end after the principal becomes incapacitated or dies. This allows agents to handle matters only for a specific period as stipulated by the principal.

Medical Power of Attorney

A Medical Power of Attorney allows the principal to assign an agent to make decisions regarding their healthcare when they become ill or incapacitated. The nature of these decisions can be specified in the legal form by the principal. For example: choosing what treatments to follow or donating their organs after death.

Limited Power of Attorney

As the name suggests, a Limited Power of Attorney document allows the principal to assign an agent with only specific areas of control for a stipulated amount of time. These are task-specific and can be dissolved after the agent has completed the task. For example: handling business transactions or one-time investments.

Springing Power of Attorney

A Springing Power of Attorney allows the principal to choose a time for the power to be granted to the agent to carry out their responsibilities. It can spring into power when the principal is not physically present to complete the task.

What is a Power of Attorney

Power of Attorney or POA is a legal transfer of designation or responsibilities from one individual to another. This can be a transfer of powers related to finance, health, ownership, guardianship, property, business, etc.

The individual who wants to delegate their power legally is called the principal, who then chooses a representative to manage affairs on their behalf or conduct specific tasks. This representative is called the agent or the 'attorney-in-fact'.

The attorney-in-fact has the power to act and make decisions for the principal. They can have a larger stake of responsibilities or a specific area of power. Different kinds of POAs can be assigned to agents, the most common types being financial (durable POAs) or healthcare (medical POAs).

In durable POAs, the agent has the authority to make decisions even after the principal has been incapacitated or is disabled. Other types of POAs do not have this allowance. They normally terminate if the principal has fallen ill or cannot act personally.

A POA is also used for matters like signing documents, closing deals, or handling transactions when the principal is physically absent.

Power of Attorney Forms by State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- Washington D.C.

- California

- Texas

- Florida

How to Get Power of Attorney

Obtaining a Power of Attorney is a big decision. Here are some essential steps to keep in mind if you consider granting someone a Power of Attorney over any aspect of your life:

1. Choose someone you trust

You need to ensure the agent you choose to assign power to is legally qualified to become a Power of Attorney. An agent cannot be in a state of bankruptcy, be below the age of the majority in your state, or own a care home you live in.

Think of a trustworthy candidate in your circle of friends or family with whom you have a good relationship and can clearly communicate your needs before signing the POA document.

2. Define the agent’s authority

Clarifying the areas you want the agent to have authority over is key. Take stock of your financial responsibilities, your dependents, the properties you own, etc., before waiving off any responsibilities. When transferring agency over to the attorney-in-fact, you can be as specific or as broad as you want.

3. Obtain the POA form

You can get a POA form in various ways. If there are large stakes involved, you can have a lawyer create a form for you and overlook the entire process. Use our POA generator to start forming your document today.

4. Fill out the POA document

You have your trusted agent, and you also have the key areas of their authority planned out. Now comes the crucial step of filling out the Power of Attorney document. You will need to be specific about when the agent’s powers should come into effect, limitations, if any, on the agent, their powers, the compensation agreed on, additional duties to be taken on by the agent, and special instructions for the agent. Each state has a different form and rules for POA.

5. Signing and notarizing

Signing the POA form is the last and most important step to successfully transferring ownership to your agent. The agent and principal both need to sign the document. Some states also require two witnesses to be present while the signing takes place. The help of a notary is also mandatory in some states.